This week (April 2023) we have seen Tropical Cyclone Ilsa intensifying rapidly as it begins final approach to Western Australia’s Pilbara region.

With traditional cyclone insurance unavailable for many areas in northern Australia, we’ve put the spotlight on the use of Parametric Insurance as a disaster resilience tool. This is a type of policy that provides coverage based on a predetermined set of parameters, which for cyclone impacts is a wind speed threshold. So unlike traditional insurance policies that typically require on-ground assessment to understand the extent of damage, a parametric insurance policy aims to pay out automatically when the agreed-upon parameters are met.

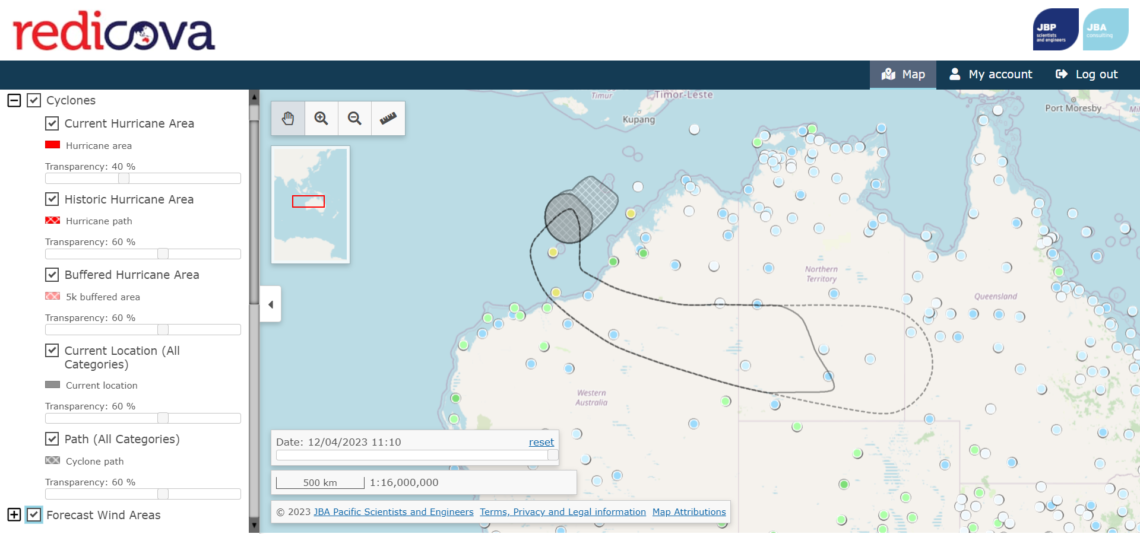

Redicova (www.redicova.com.au) is a leading example of parametric cyclone insurance in Australia, where cover is triggered when the BoM records a severe tropical cyclone (Category 3 or higher) at the insured location. Its development has been due to the ongoing efforts of Managing Director Karen Hardy, who after experiencing the financial hardship caused to her community following a severe tropical cyclone, founded Redicova to offer a new approach for any exposed communities within northern Australia.

JBP has been working with Karen on the Redicova product since 2020, which uses our real-time monitoring system developed using Delft-FEWS. Here we access gridded forecasts, high-detail forecasts, operational best cyclone track datasets, and Automatic Weather Station data, with the system tracking the “Very Destructive” wind threshold of 118 km/hr.

If you are interested in learning more about our extreme weather forecasting systems visit our website (www.jbpacific.com.au) or contact Dan Rodger on: info@jbpacific.com.au.